Our client has been operating mainly manually and using Excel tools across multiple of their work steps including:

- Accounts management

- Transactions management

- Financial report - Income statement

Our client is a European legal company that provides legal services for the B2B segment.

Standardising and automating the financial analytics and forecasting future revenue

Our client has been operating mainly manually and using Excel tools across multiple of their work steps including:

During the time and company growth, it becomes more and more difficult to maintain financial transactions and reports in Excel. Our client decided to automate financial reporting and develop forecasting based on existing data and information from CRM.

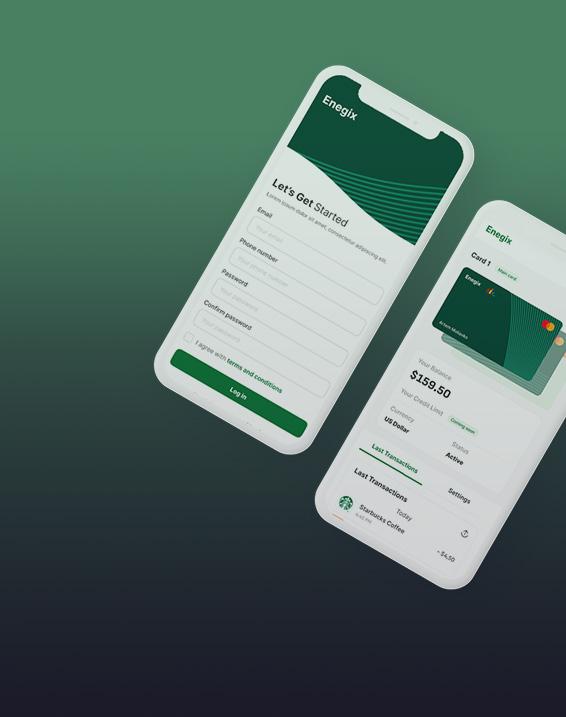

We developed a Financial Web platform that helps our client automate their financial processes.

First of all, we implemented integration between the existing CRM and the new Financial platform. It allowed us to minimize human input into the financial system. For instance, every time when a new client is added to the CRM, a new account for this client is automatically created in the financial system. It means that the accountant can immediately track any financial transactions for this client. After that we implemented double entry transaction systems which allows to track all debit and credit transactions. The system allows to add transactions manually or via API to allow other tools sync their financial data.

The future revenue forecast is a powerful mechanism for company executives to properly plan budgets and efforts.

Accountant work is simplified by smart input validation and decreasing manual work by synchronization with CRM.

Smart depreciation algorithm decreases accountant efforts on managing assets values.

This client is a large hosting data center embarked on fulfilling its ambitious goal to revolutionize the cryptocurrency exchange landscape. This corporation is a significant player in the business of web hosting, virtual private servers, and cloud storage aimed to diversify its offerings and reinforce its stance as a leader in the technology sphere.

Our client is SYTE, the world’s product discovery platform, powered by visual AI. It recognizes and recommends similar items with unprecedented accuracy in fractions of a second.

Finance Management System Software is a platform that helps organizations manage financial operations, including budgeting, accounting, reporting, and compliance, in an automated and streamlined way.

It automates key processes like invoicing, expense tracking, and financial reporting, which increases efficiency, reduces errors, and ensures better compliance with financial regulations.

Yes, most Finance Management Systems can integrate with other accounting software and ERP systems, providing seamless data flow and improving financial visibility.

It helps firms manage complex financial processes, ensures compliance with legal standards, and provides real-time insights into financial health, optimizing decision-making.

The cost varies depending on the complexity, features, and integrations required. A basic system might be more affordable, while a custom solution with advanced features will be more costly. For a precise estimate, contact our development team.

The timeline for development depends on the complexity of the project. A basic system can take a few months, while a more feature-rich, tailored solution may require six months or more to complete. Contact Clover Dynamics for a detailed timeline.